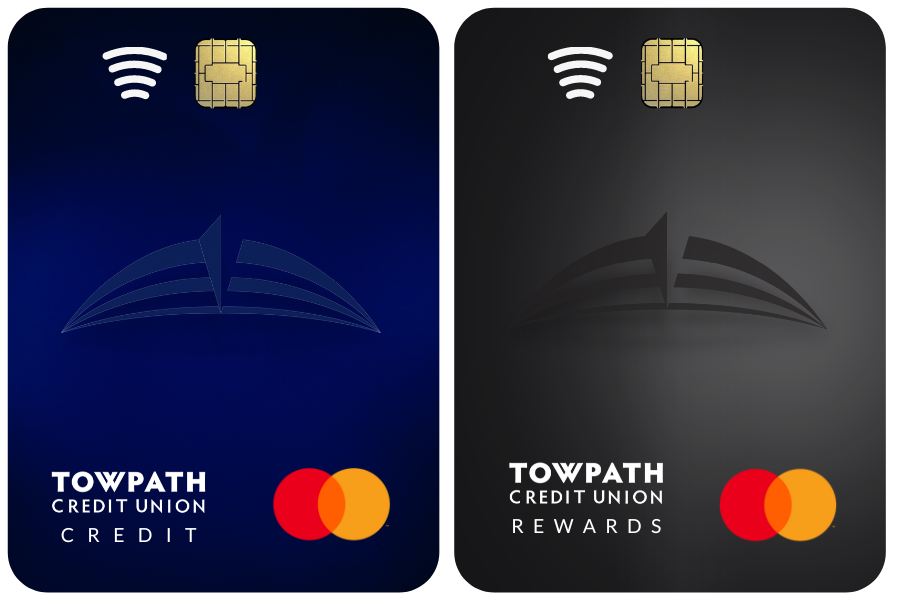

Credit Cards

EARN AND SAVE MORE

We provide links to third party websites, independent from Towpath CU. These links are provided only as a convenience. We do not manage the content of those sites. The privacy and security policies of external websites will differ from those of Towpath CU. Click "CONTINUE" to proceed or click the "RETURN TO SITE" to stay on this site.

EARN AND SAVE MORE

Use Apple Pay®, Samsung Pay®, or Google Pay® to make payments using your mobile device with your Towpath CU Debit or Credit Cards

Mobile wallets are quick and convenient and help to prevent fraud

Mobile wallets not your thing? Just use your card!

Tap your Towpath CU Debit or Credit Card at contactless-enabled payment terminals to make payments without contact!

Freeze and control your cards in our new mobile app!

Spend simply and earn rewards with the TowpathCU Rewards MastercardTM! Earn rewards points or 1.5% cash back on all purchases.1

As a special introductory offer, when you spend $1,000.00 on your TowpathCU Rewards MastercardTM in the first 60 days, you'll receive 10,000 bonus points or $100.00 cash back!2

Redeem your rewards points for cash back into your TowpathCU account or other rewards like gift cards, merchandise, travel, and more!

Have a large credit card balance with a higher rate? Multiple balances racking up interest? A Towpath CU Credit MastercardTM is also a great option as a lower-rate card.4

Receive an introductory offer of 0% APR on balance transfers for twelve months when you transfer a balance over to your Towpath CU Credit MastercardTM during the first 90 days following the opening of your account. After that, a standard purchase rate of 11.49%-25.00% APR will apply.3

If you need to build or rebuild your credit, the Secured Credit MastercardTM option may be able to help! Unlike most other secured credit cards, this card can grow with you as your credit grows. Once you build credit, there is no need to apply for a new card or open a new account on your credit report. The transition to a Towpath CU Credit or TowpathCU Rewards card is easy with responsible card use and credit union approval.

Current cardholder looking for an increase to your credit limit? Apply online today!

Total Balance

Compound Frequency

Daily

Monthly

Quarterly

Annually

Total Balance

Monthly

Quarterly

Annually

Monthly Payments

Loan Amount

Monthly Payments

| Date | Principal | Interest | Total Interest | Balance |

|---|

Original monthly payment

Original Remaining Cost

New monthly payment

New Mortgage Cost

Refinancing will save you per month and save you in total cost.